In the context of the EU tightening “green” standards, the CBAM report has become a “carbon pass” for goods exported to Europe. The CBAM report is a mandatory document that provides essential data for enterprises participating in this market. Proactively establishing a roadmap for early data collection and calculation helps enterprises enhance credibility, avoid risks, and create competitive advantages in export markets.

What is the CBAM report and who submits it?

The CBAM report is a mandatory document for goods imported into the European Union market, implemented under the carbon border adjustment mechanism (CBAM). The legal basis for the CBAM report is Regulation (EU) 2023/956 of the European Parliament and of the Council, together with Implementing Regulation (EU) 2023/1773, which specifies detailed reporting obligations. Under Regulation (EU) 2023/956, the CBAM report requires detailed declaration of emissions data generated during the production of goods in the exporting country. The report includes information on product type, HS code, imported quantity, direct emissions from production processes, and indirect emissions from electricity consumption.

The CBAM report is a mandatory document for goods imported into Europe

In essence, the CBAM report is not merely an administrative procedure, but a tool for the European Commission to measure, control, and “price” the carbon emissions of imported goods in a manner equivalent to goods produced within the EU under the EU ETS mechanism. The EU importer or an authorized customs representative within the EU is the entity that directly submits the CBAM report. For non-EU enterprises, including those in Viet Nam, although they do not directly submit the CBAM report to European authorities, they are still responsible for providing complete and accurate emissions data to their import partners. In cases where actual data cannot be provided, the EU will apply high default emission factors, leading to increased carbon costs and directly affecting product competitiveness.

How are non-EU enterprises related to the CBAM report?

During the transitional phase from October 2023 to the end of 2025, enterprises are only required to fulfill quarterly reporting obligations, with no financial obligations arising. However, from 2026, the CBAM report will serve as the legal basis for the EU to calculate and collect carbon charges. Importers must purchase CBAM certificates corresponding to the declared emissions. Although they do not directly submit CBAM reports, non-EU enterprises, particularly Vietnamese SMEs, face significant pressure because EU customers require Vietnamese exporters to ensure full transparency of production processes. All data must be consistent, traceable, and capable of explanation when inspected by EU authorities.

When implementing CBAM reporting, EU importers require non-EU enterprises to provide the following categories of information:

Mandatory data in the CBAM report

- Production activity data: Including actual figures generated during production processes, such as electricity consumption, fuel use, material inputs, and output at each production stage.

- Technology information and types of fuel used: Enterprises are required to clearly identify route codes, lists of fuels used, and electricity sources consumed. Examples include furnace technology, production lines, types of combustion fuels (coal, gas, oil, etc.), and electricity sources (national grid or self-generated electricity).

- Emission factors: Enterprises may calculate these using EU-recognized methodologies or apply default values issued by the EU if detailed data are not yet available.

- Product emission intensity: This is the most important indicator under CBAM, representing the amount of CO₂ emissions per unit of product (tonnes of CO₂ per tonne of product).

If enterprises fail to provide sufficient data or provide data of low reliability, EU importers will be required to use high default emission values, thereby increasing CBAM costs and reducing the competitiveness of goods. In practice, however, the dataset that non-EU enterprises need to prepare typically includes:

- Output by product type: Actual exported output during the reporting period, clearly disaggregated by product code, specifications, and categories.

- Related fuels, electricity, and input materials: Including electricity consumption (kWh), combustion fuels (coal, oil, gas, etc.), and primary and auxiliary materials that generate emissions.

- Emission factors:

- Emission factors for grid electricity.

- Emission factors for each type of fuel.

- Emission factors for input materials (if applicable).

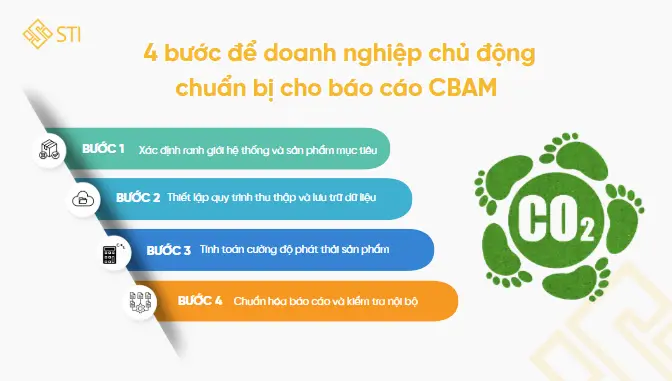

Four steps for enterprises to proactively prepare for CBAM reporting

Early preparation of CBAM data not only helps avoid the risk of losing EU orders, but also creates a “green” competitive advantage for exporting enterprises. To avoid being unprepared when the official charging mechanism is applied in 2026, enterprises should implement the following four-step roadmap:

Four steps for enterprises to proactively prepare for CBAM reporting

Step 1: Define system boundaries and target products

Enterprises need to review the HS codes of exported products to determine whether they fall under the six CBAM sectors (iron and steel, aluminium, cement, fertilizers, electricity, hydrogen). At the same time, enterprises should clearly define the boundaries of production facilities in order to delimit the scope of data to be collected.

Step 2: Establish data collection and storage procedures

Instead of annual aggregation, enterprises should develop procedures for recording operational data on a monthly or quarterly basis. Enterprises need to systematically compile electricity bills, fuel input records, furnace operation logs, and related documents. These serve as mandatory evidence in third-party verification activities and support future traceability and inspections.

Step 3: Calculate product emission intensity

Enterprises need to calculate embedded emissions, including both direct and indirect emissions. If in-house expertise is not available, enterprises should train internal personnel or engage consultants to develop calculation models in accordance with EU methodologies.

Step 4: Standardize reports and conduct internal checks

Before submission to customers, data should be standardized in accordance with reporting templates issued by the EU. Internal checks should also be conducted to ensure consistency between production data and logistics data. This is a critical step to ensure logical consistency of figures and to avoid errors that could result in penalties for partners or rejection of shipments.

Conclusion

CBAM is changing how exporting enterprises operate, as the EU market requires transparent and standardized emissions data. Early preparation of operational data collection systems, calculation of product emissions, and standardization of reporting processes not only enables enterprises to meet legal requirements from 2026, but also creates sustainable competitive advantages within global supply chains. Enterprises that gain early control over CBAM reporting will be able to proactively manage carbon costs, maintain orders, and enhance their position in the EU market over the long term.

Enterprises may contact STI Viet Nam for consultation support in building a standardized CBAM roadmap and ensuring the highest level of emissions data accuracy.