The EU has long been a lucrative market for steel exports; however, the CBAM framework presents the Vietnamese steel industry with a major hurdle regarding embedded carbon emissions. Once considered a “gold mine” for steel exports, with regulations tightening, enterprises are forced into a binary choice: sacrifice a billion-dollar market share or transition to a green production model. Under the pressure of this new carbon levy, how can Vietnamese steelmakers ensure they are not edged out of the global supply chain?

Vietnamese Steel Exports in the EU Market

Since the EU-Vietnam Free Trade Agreement (EVFTA) came into effect, the EU has become a “promised land” for many Vietnamese steel exporters. Transforming from a net importer, Vietnam has risen to become the largest steel producer in ASEAN and the 13th largest in the world, with crude steel output reaching approximately 20 million tons in 2023, and growth is expected to continue. In 2024, despite global geopolitical and economic fluctuations, Vietnam’s steel industry maintained impressive export momentum. According to data from the General Department of Customs and international associations, Vietnam exported over 12.6 million tons of steel in 2024, an increase of more than 13% compared to the previous year. By the first half of 2025, Vietnam exported 5.66 million tons of steel with a turnover of 3.7 billion USD; the EU ranked as the second-largest market with 1.1 million tons (approximately 771 million USD), trailing only ASEAN.

Vietnam Steel Exports in the EU Market (Source: Internet)

Vietnam Steel Exports in the EU Market (Source: Internet)

In Vietnam, steel products exported to the EU have moved beyond raw materials, penetrating deeply into high-value-added segments. The main categories include:

- Steel Billets: An important input material. Although exported in large volumes, profit margins are typically lower and subject to fierce price competition.

- Flat Steel (HRC, CRC): Hot-rolled and cold-rolled coils are key product groups serving the automotive and mechanical engineering industries in Europe.

- Long Steel (Construction Steel): Primarily serves infrastructure projects.

- Deep-processed Steel Products: Including color-coated steel, galvanized steel, and steel pipe products. This group has high growth potential but requires the most stringent technical standards.

The steel industry plays a crucial role in supplying the EU market but faces major hurdles from CBAM. Starting in 2026, when CBAM officially implements financial obligations, the Vietnamese steel industry will face a new “technical barrier” replacing traditional tariffs. Under this mechanism, steel exporters must purchase CBAM certificates. The price of these certificates depends on the weekly average auction price of the EU Emissions Trading System (ETS), expressed in EUR/ton of CO2 emitted. Consequently, Vietnamese steel companies must plan to reduce carbon emissions in production to remain competitive in value against global rivals.

Why Does CBAM “Hit Hard” on the Steel Industry?

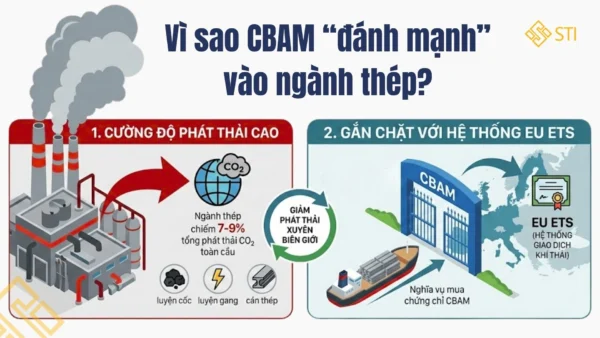

CBAM does not apply to all goods simultaneously from the start but focuses on six commodity groups with the highest risk of “carbon leakage,” including: Iron & Steel, Cement, Aluminum, Fertilizers, Electricity, and Hydrogen. Among these, the steel industry is viewed as a primary target for two core reasons:

- Steel has high emission intensity: The steel industry is one of the highest greenhouse gas (GHG) emitting industries globally, accounting for 7-9% of total global CO2 emissions. Production processes ranging from coking and iron smelting to steel rolling consume vast amounts of energy, particularly coal and fossil fuels. Furthermore, emissions such as CO2, NO2, and SO2 all contribute to accelerating climate change. For the Vietnamese steel industry, controlling and reducing emissions is not just an international requirement but an intrinsic responsibility to maintain competitiveness.

- Tight integration with the EU Emissions Trading System (EU ETS): The EU’s CBAM policy is built upon the EU ETS, aiming to reduce cross-border GHG emissions in the global supply chain. Steel is a focal point due to its high emission intensity and its key role in reducing the EU’s total GHG footprint. This means importers of steel from non-EU countries must face obligations to purchase CBAM certificates matching the emissions of the imported products. This is a strictly controlled mechanism designed to encourage non-EU countries to raise environmental standards in steel production. Vietnamese steel companies must research, adapt, and prepare appropriate solutions to avoid falling behind or losing market share in Europe. Simultaneously, this drives domestic enterprises to improve technological efficiency and transparency in emissions reporting.

The steel industry faces significant exposure to CBAM

The steel industry faces significant exposure to CBAM

How Does CBAM Impact Vietnamese Steel Enterprises?

Although it is a key export group to the EU, steel production remains one of the most emission-intensive industries globally. The majority of steel output in Vietnam is still produced using Blast Furnace (BF-BOF) technology, which utilizes iron ore and coke. This technology emits extremely high levels of CO2, averaging about 1.8 – 2.0 tons of CO2 per ton of crude steel. Meanwhile, in the EU, steel plants have shifted to cleaner technologies such as Electric Arc Furnaces (EAF) or utilized renewable energy to meet strict local regulations.

Therefore, to secure market share in the EU, enterprises must establish international-standard GHG inventory systems and provide transparent, detailed emissions data to import partners. If the product’s “carbon footprint” cannot be proven, the door to the EU market will gradually close.

From 2026, EU importers (customers) must buy “CBAM certificates” corresponding to the carbon emitted to produce that steel. The price of this certificate is based on the auction price of the EU ETS, currently fluctuating around 60-90 Euro/ton of CO2 and forecast to rise. With high emissions of roughly 2 tons of CO2 per ton of steel (the average for blast furnaces), Vietnamese businesses could burden an additional cost of over 100-150 Euro per ton when exporting to the EU. This makes the price of Vietnamese steel difficult to compete with rivals possessing greener technology or domestic EU steel. Vietnamese steel enterprises face “double” pressure: accepting price adjustments to retain EU customers or investing in technical improvements, production processes, and transitioning to green technology to minimize emissions.

CBAM: A Barrier or a Catalyst for Innovation?

As the EU tightens CBAM, EU customers will prioritize exporters with low emission intensity because importers will have to buy CBAM certificates corresponding to the carbon emissions in the imported products. This exposes Vietnamese businesses to the risk of losing orders and being replaced by suppliers with lower emission intensities. Once the EU market is lost, Vietnamese steel companies will likely soon lose markets such as the US, Japan, and Canada as they apply similar mechanisms.

However, if Vietnamese steel enterprises utilize the transition period effectively, CBAM will be a “push” for businesses to:

- Innovate Technology: Transition from blast furnaces (BF-BOF) to electric arc furnace (EAF) technology or invest in more efficient steel rolling technology.

- Optimize Raw Materials: Increase the ratio of scrap steel usage and apply renewable energy in production.

- Build a Brand: Position the “Green Steel” brand of Vietnam, creating a unique regional advantage.

CBAM is a “barrier” for Vietnamese steel enterprises, but it is also an excellent “catalyst” for sustainable development. At the same time, this is an opportunity to aim for the 2025 goal of a sustainable Vietnamese steel industry, competing strongly in the international market, contributing to environmental protection, promoting energy transition, and moving towards a greener, cleaner industry.

Conclusion

In the context of tightening CBAM regulations in the EU, the Vietnamese steel industry faces challenges but also encounters new development opportunities. Maintaining this position not only brings significant foreign currency revenue but also serves as a “seal of approval” for the quality of Vietnamese steel when penetrating other demanding markets such as the US or Japan.