CBAM – the carbon border adjustment mechanism is becoming a primary concern for enterprises exporting to the EU. In particular, the period from late 2025 to early 2026 represents a critical transition from “data reporting” to “financial obligation”, during which emissions data and compliance capability will directly affect product costs and competitiveness in the EU market. This article provides a specific checklist to help Vietnamese small and medium-sized enterprises (SMEs) proactively seize opportunities to develop a “green” roadmap that meets the stringent requirements of the EU market.

What are the key CBAM timelines?

CBAM implementation is divided into two phases: the transitional phase and the definitive phase. A clear understanding of CBAM timelines enables Vietnamese enterprises to maintain competitive advantages in the EU market.

1. Transitional phase (10/2023 – 12/2025)

During this phase, the EU does not yet impose CBAM certificate requirements. EU importers are obligated to submit quarterly CBAM reports based on emissions data embedded in goods supplied by exporters (Vietnamese enterprises). The reporting scope includes both direct greenhouse gas emissions (from production processes) and indirect emissions (from electricity consumption).

Reporting is conducted transparently through the CBAM transitional registry of the European Commission. This system serves as a central information portal that allows for:

- Information exchange between importers and suppliers.

- Data verification by competent authorities and customs.

- Direct communication between declarants and the European Commission.

Although no financial obligation applies at this stage, this is a key phase for “data standardization”. Therefore, enterprises should use this period to establish and refine internal measurement, reporting, and verification (MRV) systems in line with international standards, in preparation for the definitive phase starting in 2026.

2. Definitive phase (from 01/2026)

From this point onward, CBAM becomes fully operational, shifting from emissions reporting to financial obligations. EU importers are required to purchase and surrender CBAM certificates corresponding to the embedded emissions (CO₂e) contained in imported products. The price of each CBAM certificate is determined based on the average weekly auction price of carbon allowances on the EU ETS market (expressed in euro per tonne of CO₂ emitted). This ensures that carbon costs for imported goods are equivalent to those borne by EU producers. Notably, emissions data are no longer self-declared only, but must be verified by an accredited independent third party. However, the financial obligation will not be applied at 100% immediately; it will increase gradually in line with the phase-out of free allowances under the EU emissions trading system (EU ETS). From 2026 to 2033, CBAM costs will rise annually, and by 2034 CBAM will be fully aligned with the EU ETS. Accordingly, exporters will bear 100% of carbon costs if they cannot demonstrate emissions reduction efforts.

Key CBAM milestones that enterprises need to note.

Enterprises experiencing difficulties in emissions data declaration may contact STI Viet Nam for advisory support.

Why 2025–2026 is a “pivotal period” for Vietnamese SMEs

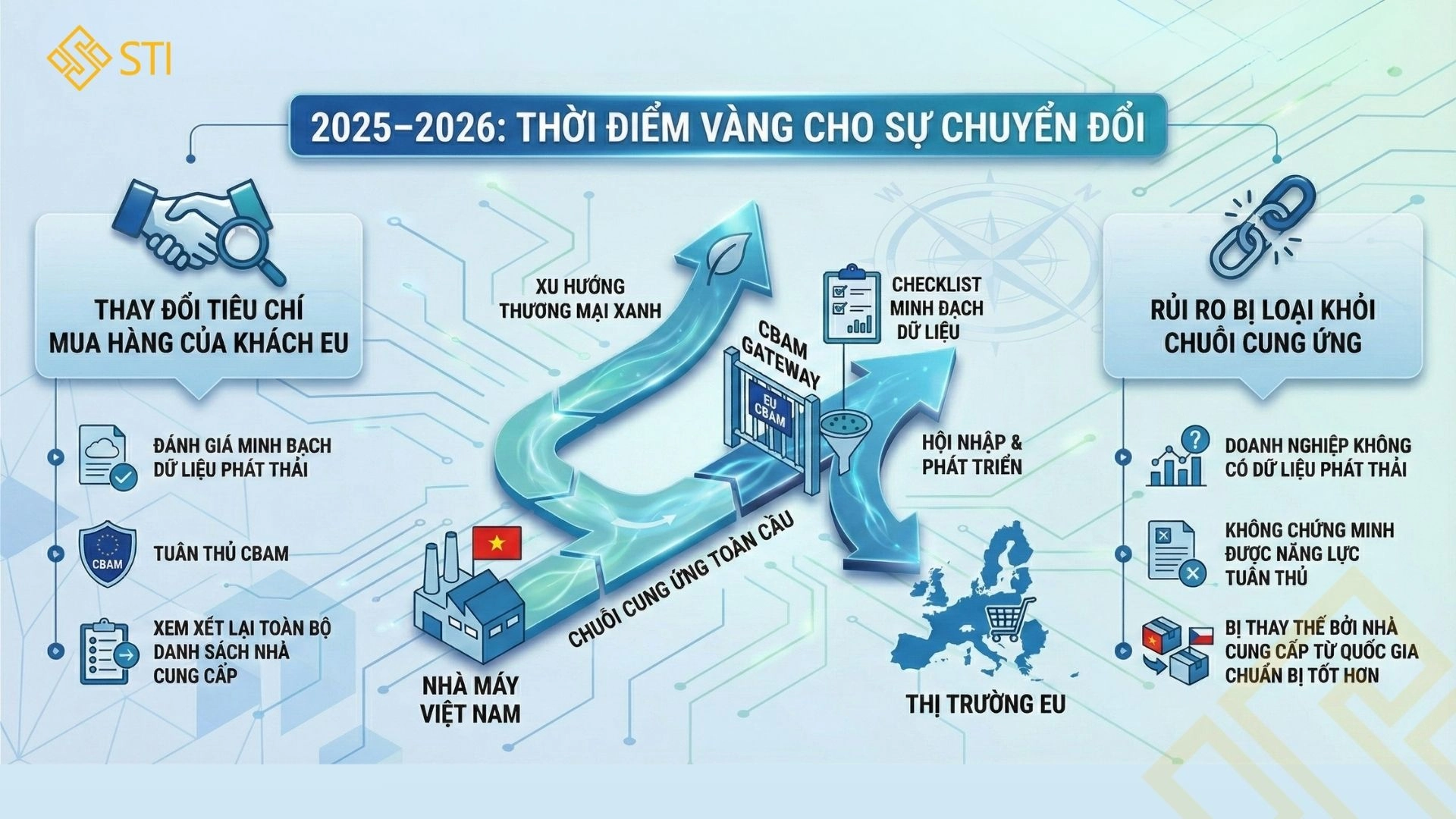

International trade is rapidly shifting toward a “green” orientation, and the EU carbon border adjustment mechanism (CBAM) is receiving increasing attention. For Vietnamese small and medium-sized enterprises (SMEs), the 2025–2026 period is considered a “window of opportunity”. This is not only a period for comprehensive system standardization, but also a time when the EU market reassesses and filters supply chains.

Although CBAM will be officially operational from 2026, the 2025–2026 period is decisive for two core reasons:

- Changes in procurement criteria: EU customers no longer focus solely on price and quality. They are beginning to reassess supplier lists based on emissions data transparency and the ability to meet CBAM requirements.

- Risk of exclusion: Enterprises that cannot provide preliminary emissions reports or demonstrate compliance capability may be replaced by EU importers with partners from countries that are better prepared, in order to avoid legal risks and potential future carbon costs. Once market share is lost in this “high-value” market, Vietnamese SMEs may find it difficult to regain access.

2025–2026 period: a window of opportunity for Vietnamese enterprises

Six-step checklist that SMEs need to implement immediately

To turn challenges into opportunities, enterprises need to take immediate action to meet CBAM requirements. Below is a specific six-step roadmap for SMEs to enter the EU “green” supply chain.

Step 1: Review HS codes (CN codes)

Not all products are subject to CBAM immediately. In the initial phase, CBAM focuses on six product groups with specific HS codes. Therefore, enterprises should review their export product lists and compare HS codes to determine whether products fall within the CBAM scope (including iron and steel, aluminium, cement, fertilizers, electricity, hydrogen, etc.). Based on this, an appropriate compliance roadmap should be developed.

Step 2: Map the value chain

Enterprises need to clearly understand their position to define the reporting scope: whether they are direct manufacturers (direct emissions), processing entities, or traders supplying raw materials. This enables determination of which emissions must be declared, which data are self-collected, and which data must be obtained from suppliers.

Step 3: Establish an operational data collection system

Data are a key “asset” for CBAM reporting. Enterprises cannot report without data. Therefore, enterprises should establish data collection systems, prioritizing data digitalization from the outset to avoid gaps during reporting. Data to be monitored include:

- Electricity consumption.

- Fuel usage.

- Input raw materials.

- Output volumes.

- Equipment and production technologies.

Step 4: Calculate and estimate emissions intensity

This is the most technically challenging yet most important step. Based on collected data, enterprises should begin calculating emissions per unit of product (tCO₂e/tonne of product). At the same time, enterprises need to familiarize themselves with CBAM-compliant calculation methodologies to estimate emissions intensity preliminarily and prepare systems to meet the official CBAM calculation methods when mandatory. This enables enterprises to estimate potential CBAM costs from 2026 and proactively adjust pricing and commercial contracts.

Step 5: Proactively engage with EU customers

To ensure that reporting fully meets CBAM requirements, enterprises should work with EU import partners to determine:

- Emissions data requirements: data scope (direct emissions, indirect emissions, and precursor emissions), and default emission factors.

- Data submission frequency: quarterly, to ensure EU customers have sufficient time to prepare subsequent quarterly reports.

- Data format: to ensure that spreadsheets or data files provided align with the information fields required for entry into EU reporting systems.

Step 6: Develop an improvement plan

To meet stringent EU requirements, enterprises should proactively prepare emissions reduction strategies, including:

- Energy management and optimization.

- Improvement of technologies and production processes.

- Identification of raw material sources with lower emission factors.

- Gradual adoption of clean energy solutions, such as rooftop solar and renewable energy.

Six-step roadmap for Vietnamese SMEs

Conclusion

CBAM is reshaping the entire supply chain into the EU. From now until 01/2026 is a “window of opportunity” for enterprises to enhance emissions measurement capabilities and prepare for mandatory financial obligations from 2026. Enterprises that take early action will have opportunities to strengthen “green export” advantages and reduce the risk of exclusion from the EU market.

Enterprises may contact STI Viet Nam to receive consultation on a rapid, accurate, and quality compliance roadmap.