The carbon border adjustment mechanism (CBAM) of the European Union (EU) officially entered the transitional phase from October 2023. This is not only a new technical barrier but also a screening mechanism for global supply chains. In particular, for six high-emission product groups, Vietnamese enterprises are facing “dual pressure”: the need to ensure data transparency while optimizing carbon costs in order to maintain market share in the EU.

Why did the EU introduce CBAM? What impacts do Vietnamese enterprises face under carbon-related challenges?

Why the EU introduced CBAM

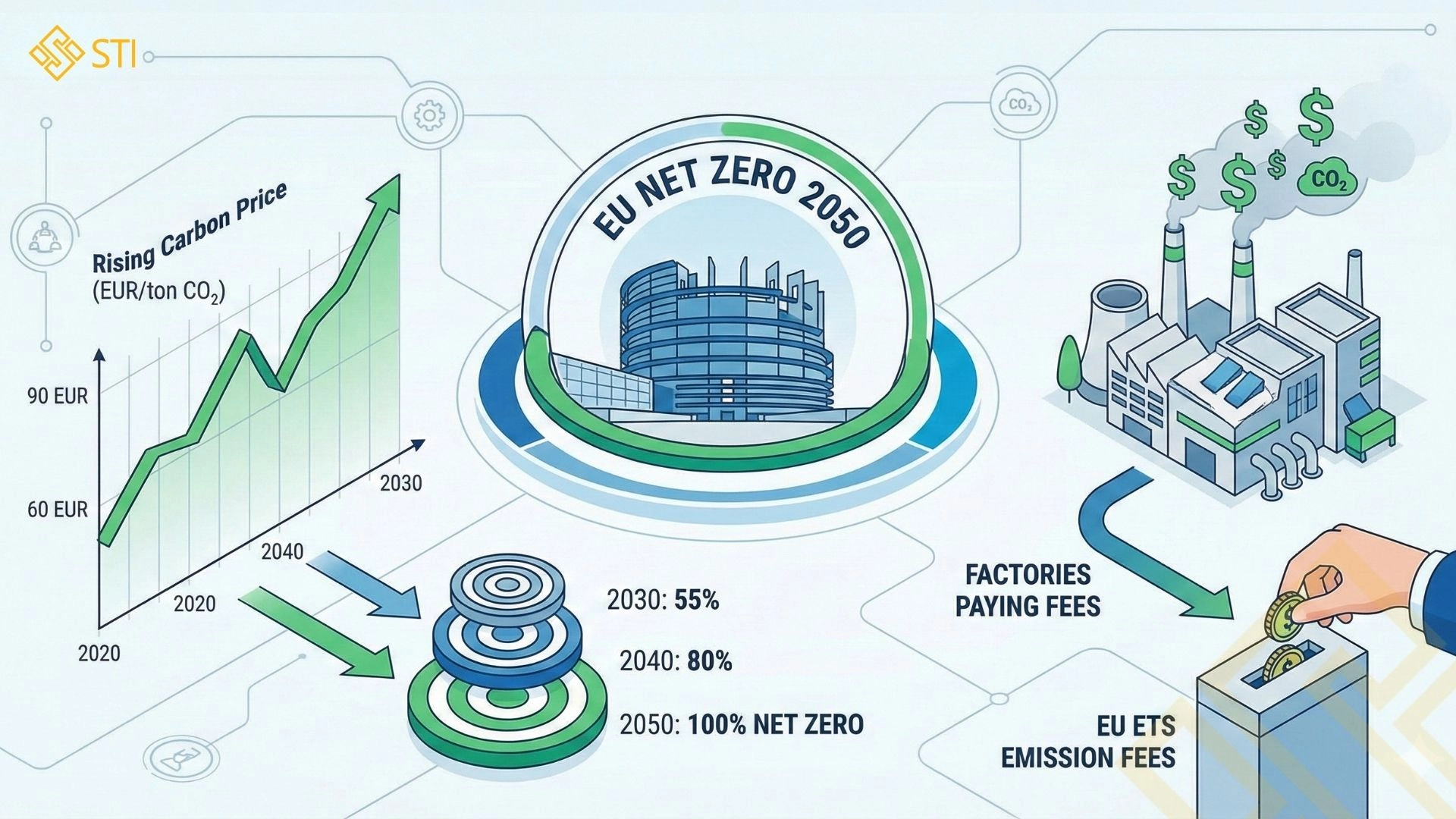

The EU has set the objective of achieving carbon neutrality by 2050 (net zero). To move toward this objective, the European Union applies the EU ETS – the Emissions Trading System – which requires all enterprises within the bloc to pay a fee for each tonne of CO₂ emitted. This is a mechanism that makes production costs increase in proportion to emissions.

Carbon prices under the EU ETS are not fixed but fluctuate significantly according to market conditions, typically ranging from approximately EUR 60–90 per tonne of CO₂ in recent years, and exceeding EUR 100 at certain peak periods. As the EU tightens the emissions cap year by year, the volume of free allowances gradually decreases, requiring enterprises to purchase additional quotas at increasingly higher prices. As a result, carbon costs become a significant component of production costs, compelling manufacturers to invest in cleaner technologies, upgrade equipment, and optimize energy use in order to maintain long-term competitiveness.

However, as carbon prices in Europe increase, some EU enterprises tend to relocate production to countries that do not apply carbon pricing, including Viet Nam. This does not reduce global emissions but instead shifts them to other countries, creating the risk of carbon leakage.

CBAM is considered part of the EU’s objective of achieving carbon neutrality by 2050.

Six high-emission product groups within the scope of CBAM

1. Distinguishing between “industry” and “product group” under CBAM

This is a point that many Vietnamese enterprises currently misunderstand.

Industry: A broad scope of economic activity, for example: the steel industry, cement industry, aluminium industry, chemical industry. An industry includes many different types of products, not all of which necessarily fall under CBAM.

Product group – CBAM application level: CBAM applies at very specific HS/CN codes (detailed to 6–8 digits), not to an entire industry.

Examples:

-

The steel industry has more than 500 product codes, but only approximately 100 HS codes fall under CBAM.

-

The fertilizer industry is very broad, but CBAM applies only to certain codes such as urea (3102), NPK (3105), and ammonia (2814).

-

Within the aluminium industry, only certain aluminium alloy codes are subject to carbon charges.

2. Six high-emission industries within the scope of CBAM

In the initial phase, the EU applies CBAM to six high-emission product groups with the highest risk of carbon leakage. These are foundational industrial sectors that consume large amounts of energy and emit CO₂ directly during production.

| Product group | HS code (typical) | Typical Vietnamese products | Export situation to the EU and impact |

|---|---|---|---|

| 1. Iron and steel | 7208–72177301–7307 | Hot-rolled coil (HRC), structural steel, stainless steel, steel pipes, steel structures. | HIGH impact:Exports to the EU increased significantly (~1.36 million tonnes in the first half of 2023).The EU accounts for 12–20% of Viet Nam’s steel export market (USD 1–2 billion/year). |

| 2. Cement | 2523 | Clinker, PCB40 cement, bulk cement, Portland cement. | SIGNIFICANT impact:Viet Nam is among the world’s leading cement exporters.Approximately 4.7% share of EU cement imports.Very high emission intensity. |

| 3. Aluminium | 7601–7609 | Aluminium profiles, aluminium foil, aluminium billets, aluminium alloys, aluminium sheets. | MEDIUM impact:Exports to the EU of approximately USD 65 million (2022).Small proportion (~0.6% of Viet Nam’s total aluminium exports). |

| 4. Fertilizers | 2808, 2814, 3102, 3105 | Urea, NPK, DAP. | LOW impact:Industry mainly serves the domestic market.Export share to the EU is close to 0%. |

| 5. Electricity | (No HS code) | Electricity generated from coal-fired thermal power plants (contributing to the grid). | INDIRECT impact:No direct exports to the EU.Note: Emissions costs from electricity will be counted as indirect emissions of other industrial products (such as steel and aluminium). |

| 6. Hydrogen | 2804.10 | Green/renewable hydrogen (pilot projects). | POTENTIAL impact:No large-scale exports at present.Included in the list to standardize future clean energy sources. |

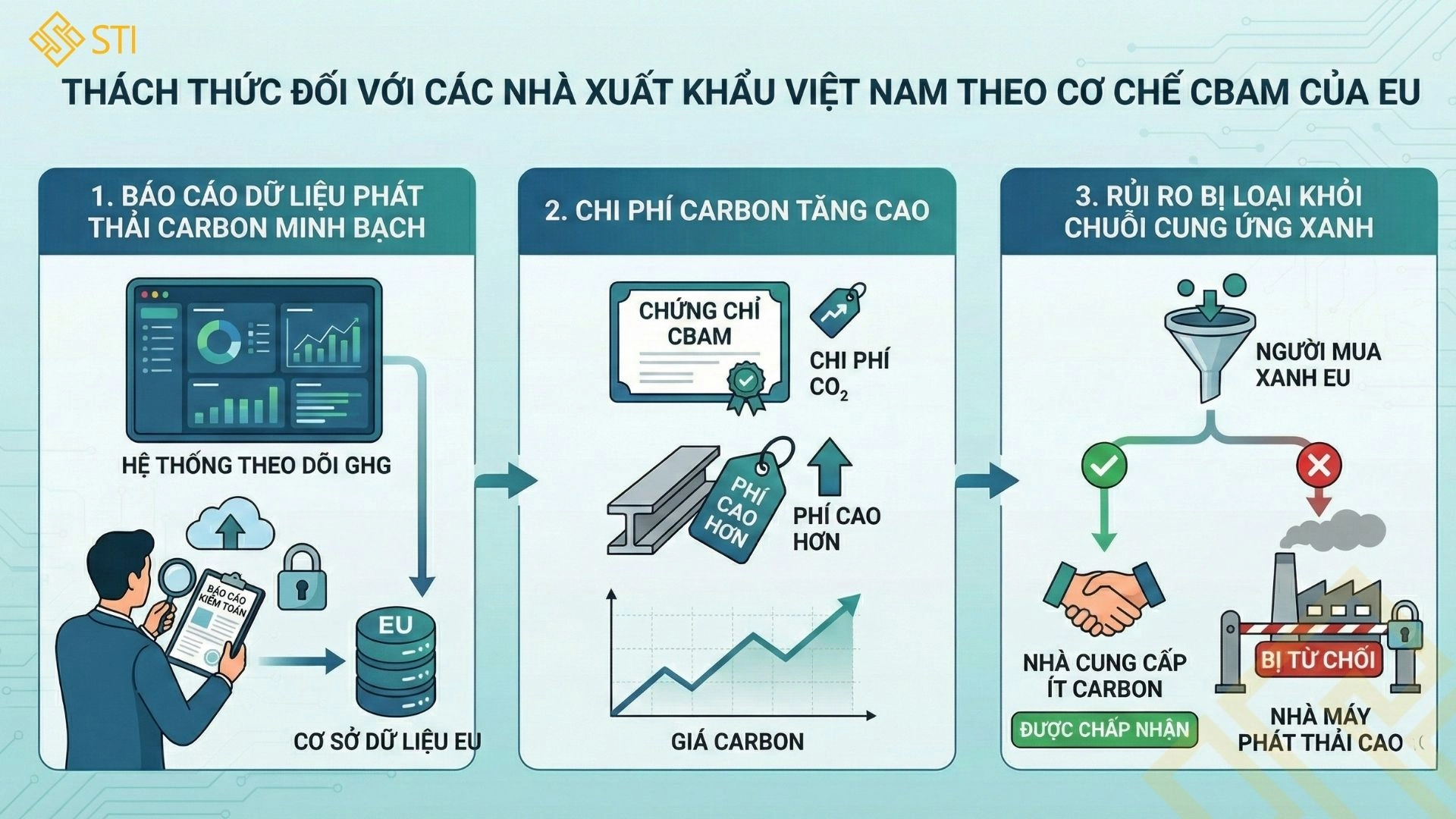

Challenges posed by CBAM for Vietnamese enterprises

1. Emissions data transparency

The EU requires exporting enterprises to provide detailed greenhouse gas (GHG) emissions information for each shipment. Even during the transitional phase, EU importers will require accurate reporting of emissions associated with products and will submit these reports to EU authorities. This obliges Vietnamese enterprises to begin monitoring, aggregating, and verifying emissions data throughout the entire production chain.

2. Carbon costs incorporated into product prices

When CBAM enters the implementation phase (expected from 2026), EU importers will be required to purchase “CBAM certificates” corresponding to the CO₂ emissions of the products. This means that carbon costs will be added to the selling price of Vietnamese goods. For example, according to calculations, if steel plants do not reduce emissions, CBAM costs may increase export steel prices and reduce competitiveness.

3. Risk of exclusion from “green” supply chains

The EU will prioritize environmentally friendly suppliers. Studies indicate that carbon costs may increase the price of Vietnamese steel and erode its competitive advantage, potentially leading to substitution by cleaner-producing competitors. Failure to comply with CBAM or to demonstrate low emissions may result in exclusion from long-term orders. In the near future, emissions information will carry weight comparable to product quality; in other words, transparent carbon data is becoming a key criterion determining business opportunities with the EU.

Challenges for Vietnamese exporters under the EU CBAM mechanism

Opportunities if enterprises proactively adapt

Although CBAM creates significant pressure, Vietnamese enterprises can convert challenges into opportunities if they begin the transition early. Optimizing energy use and raw materials will help enterprises not only reduce emissions but also lower production costs. Improved operational efficiency enhances competitiveness and establishes a foundation for long-term sustainable development.

Enterprises that proactively comply with CBAM open up new opportunities.

Another benefit is that emissions transparency enables enterprises to build the image of a “green supplier” in the eyes of EU customers. As global corporations intensify emissions reduction commitments, enterprises that meet carbon standards will have greater opportunities to secure higher-value orders and long-term partnerships.

Finally, CBAM functions as a strong “market filter.” Enterprises that proactively comply and invest systematically in carbon management will gain advantages over less transparent competitors, creating a sustainable competitive gap as the EU market increasingly prioritizes green products.

Enterprises may contact STI Viet Nam for a free lookup and to receive consultation on a rapid, accurate, and quality compliance roadmap.